by Mary Frances Mir, MSN, RNC, CMC – Aging Life Care Association™ Member

With Financial Elder Abuse on the Rise, It is Important to Know What to Look For

The phrase “elder abuse” often brings to mind images of physical or emotional abuse. For many elders, however, the abuse is financial. The most common form of financial elder abuse encountered is theft by family, friends, neighbors, and caregivers. Individuals that have a with a fiduciary or caregiving responsibility to an elderly person may take advantage of their finances when they are emotionally or physically vulnerable.

Families with older relatives need to know the warning signs of this all too common and often hidden form of elder abuse. Here are three of the most common signs an elderly person may be experiencing financial abuse by someone who is caring for them:

1. Unusual Activity in Bank Accounts

A simple review of the monthly bank statement can reveal unusual activity. Be sure to watch for any withdrawals from ATMs – particularly if the senior is not mobile or doesn’t normally use an ATM. Watch for unusual use of a debit card. If purchases are being made at stores you know the senior does not shop, report the activity to the bank for verification. Unexplained movement of funds from one account to another can be another indication that money is going to someone it shouldn’t.

2. Signatures That Don’t Match

Forging a signature on a check or other document is a crime, but older adults who have difficulty with vision or writing may ask others to sign for them. It is important to ensure that anyone who is signing checks or legal documents for an older adult has the legal authority to do so. Let their bank know you are concerned about fraudulent activity, and ask them to verify all signatures. Bank employees are mandatory reporters of elder abuse.

Request a copy of the older adult’s credit history at least once a year. This will easily identify any accounts that have been opened in the senior’s name without their knowledge.

3. Changes in Behavior

Financial abuse of seniors is a growing problem. Families with older relatives need to know the warning signs of this all too common and often hidden form of elder abuse.

Financial abuse of seniors is a growing problem. Families with older relatives need to know the warning signs of this all too common and often hidden form of elder abuse.

Changes in behavior are not necessarily related only to emotional abuse. An older adult who is suddenly missing personal items such as jewelry or electronics may be in a dangerous situation. If there is someone new in their life that they are suddenly giving these items to, it is important to understand why.

A lack of amenities can be another red flag. If they are giving items away – such as televisions, expensive tools, or other valuable household items – it is important to find out why. If the older person is no longer eating out at favorite restaurants, visiting the salon routinely, or buying small gifts for family members like before and says it is because they can no longer afford it, take a closer look at the situation.

Isolation is another problem. If you are not being allowed to speak to the senior or told they don’t want to speak to you it is vital to keep trying. An isolated adult is at risk of undue influence and vulnerable to multiple types of abuse, including financial.

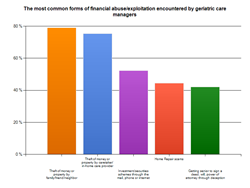

In 2014, members of the Aging Life Care Association were surveyed about their experiences with financial abuse in their work with seniors. 71 percent reported that financial abuse is a growing problem in their communities. The survey also identified the top five types of elder abuse most commonly encountered:

- Theft of money or property by family/friend/neighbor

- Theft of money or property by caretaker/ in-home care provider

- Investment/securities schemes through the mail or phone

- Home Repair scams

- Getting senior to sign a deed, will, power of attorney through deception

Helping a senior loved one avoid financial abuse requires close oversight by family members or qualified professionals. Monthly reviews of statements, bills, and other financial information may prevent theft, fraud, or financial abuse before it happens.

To learn more about elder abuse and how to report it, visit the National Center on Elder Abuse. An experienced Aging Life Care Professional can also be a valuable resource and line of defense against financial abuse. To find an expert in your area, search this directory of members.

This blog is for informational purposes only and does not constitute, nor is it intended to be a substitute for, professional advice, diagnosis, or treatment. Information on this blog does not necessarily reflect official positions of the Aging Life Care Association™ and is provided “as is” without warranty. Always consult with a qualified professional with any particular questions you may have regarding your or a family member’s needs.